Financial Inclusion

- Expand your market reach and support underserved customer segments

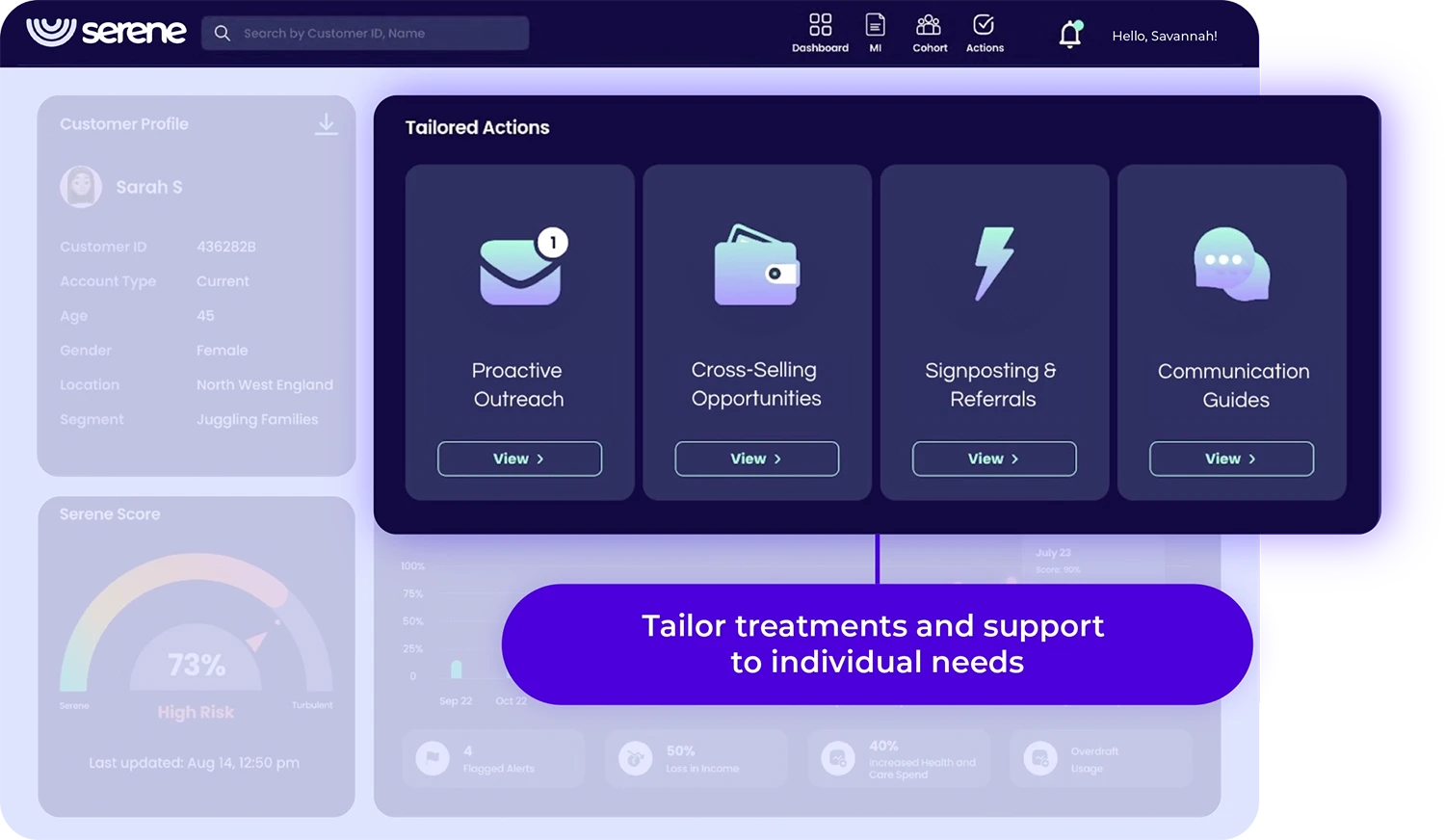

- Develop targeted strategies to serve more needs better

- Build long-lasting relationships through personalised guidance and support

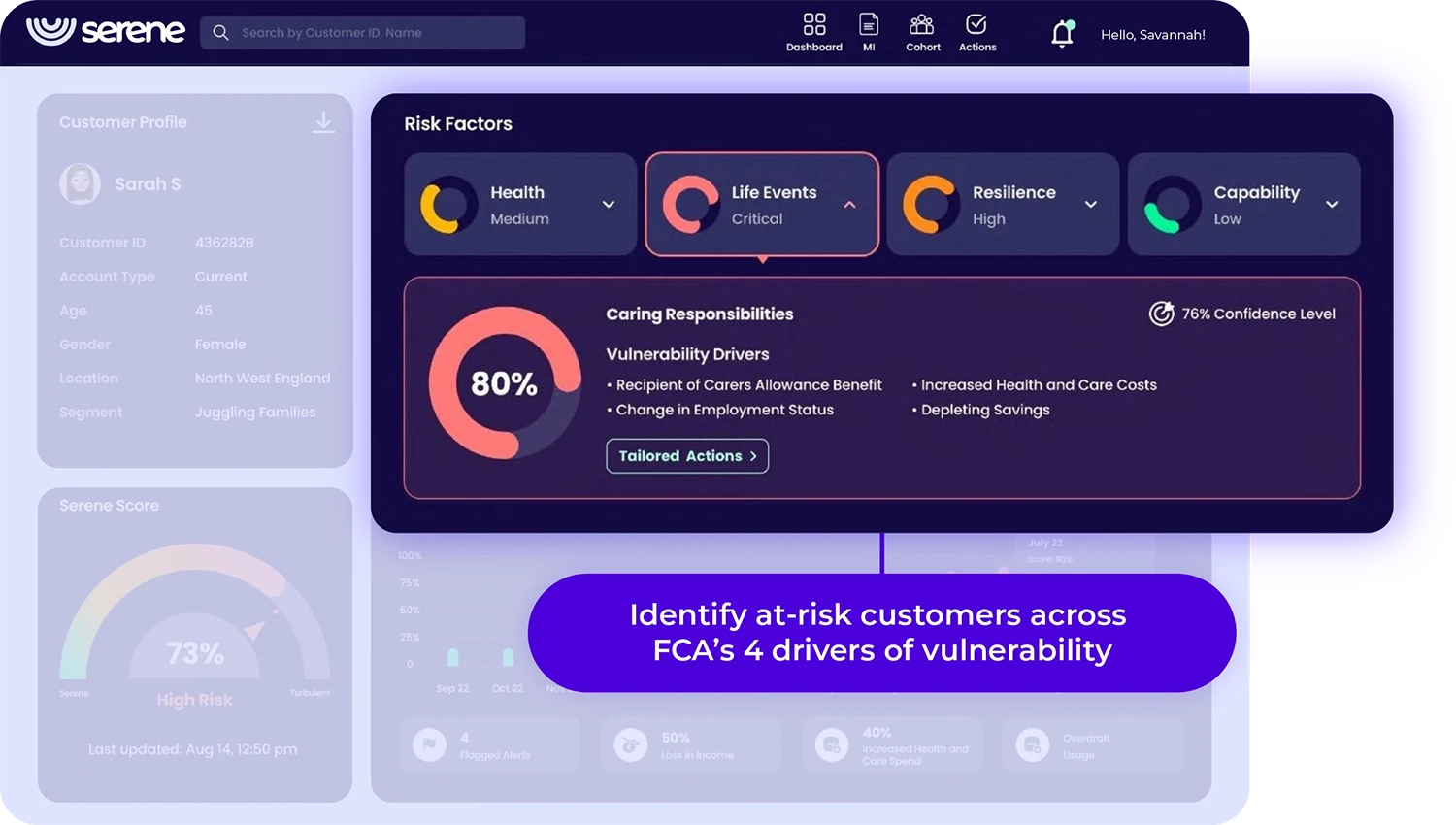

Harness intelligent insights to proactively mitigate risk, ensure compliance, and enhance customer well-being.

Drive good outcomes for business and society

Serene’s comprehensive toolkit for proactive Vulnerability Management

We’re proud to be supported by a growing number of leading organisations

From onboarding to account management and collections, Serene improves customer outcomes and drives commercial value

Enrich customer care efforts with dynamic, data-driven vulnerability assessments and targeted support.

Learn More

Enhance affordability assessments, enable responsible lending, and compassionately guide customers through hardship.

Learn MoreConnect with Serene today to learn how we can help you identify, understand, and support your customers.

Notifications